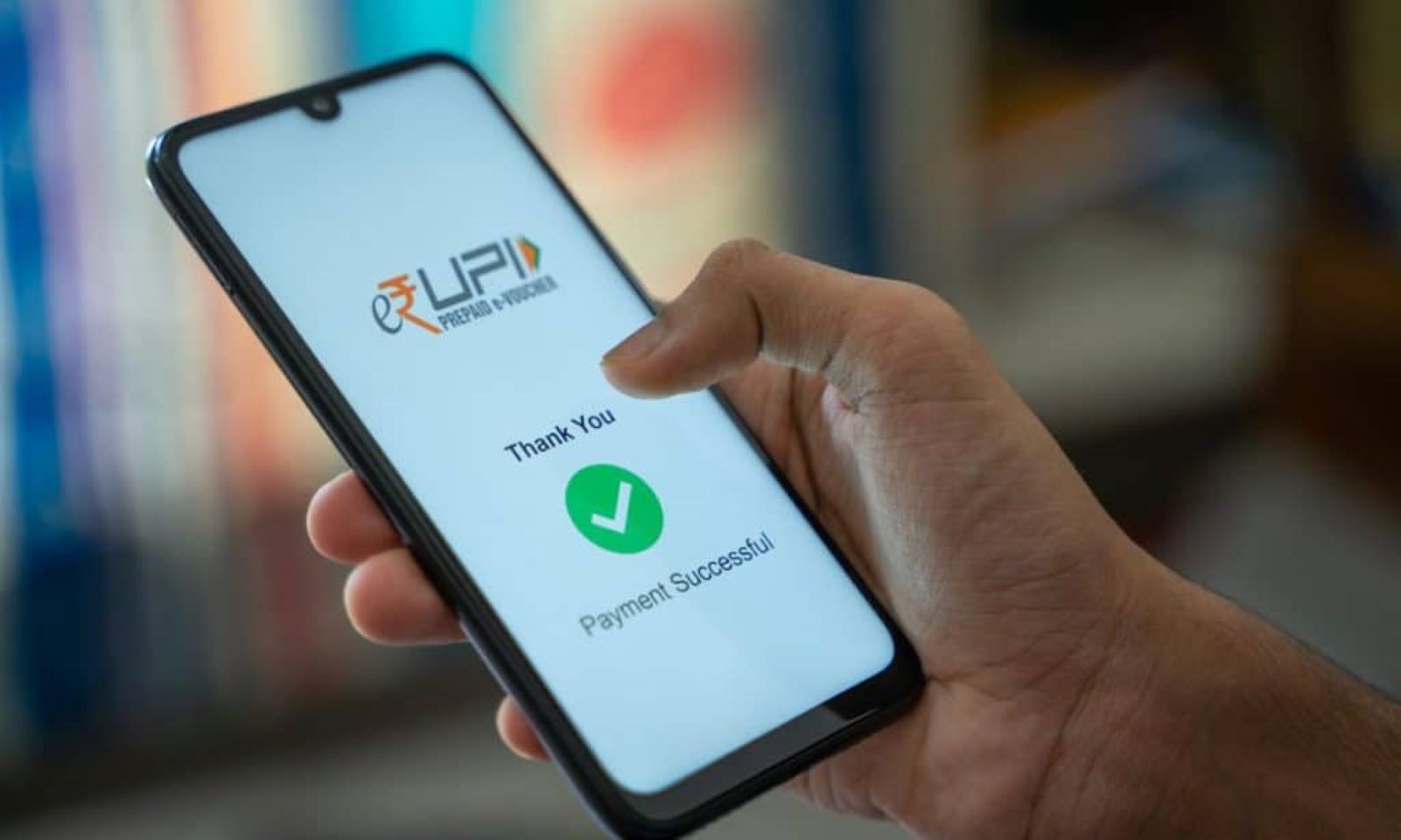

In a significant revelation, External Affairs Minister S Jaishankar highlighted that India’s monthly cashless transactions have surpassed the total number of digital payments made in the United States over three years. This statement underscores the dramatic shift towards digitalization in India’s financial transactions, reflecting the country’s rapid embrace of technology in everyday life.

Jaishankar’s remarks came during his interaction with the Indian community in Nigeria, emphasizing how technological advancements have simplified the lives of Indian citizens. The use of cash has significantly declined, with a vast majority of transactions now being conducted digitally. This transition is largely attributed to the widespread adoption of the Unified Payments Interface (UPI), a system that has revolutionized the way payments are made in India.

The growth of UPI transactions has been nothing short of extraordinary, registering a compound annual growth rate of 147% from the financial year 2017-18 to 2022-23. The Reserve Bank of India (RBI) has been instrumental in this surge, implementing various measures to expand UPI’s reach, including increasing transaction limits and introducing features like ‘instant credit via UPI’ and UPI Lite X for conducting transactions without an internet connection.

Jaishankar’s comparison not only highlights India’s technological prowess but also its role as a global leader in digital payments. With a robust infrastructure that supports real-time transactions, India is setting a benchmark for digital economies worldwide. This digital payment revolution has contributed significantly to the ease of doing business, promoting economic growth, and enhancing the overall quality of life for its citizens.

Jaishankar’s visit to Nigeria, where he shared these insights, also included co-chairing the sixth India-Nigeria Joint Commission Meeting (JCM) and engaging with business delegates and leaders to further strengthen India’s international relations and economic ties.

This transformative leap in digital payments is a testament to India’s innovative approach to overcoming challenges and its commitment to leveraging technology for economic and social advancement. As India continues to make strides in the digital domain, its model of digital payment infrastructure is becoming a blueprint for countries aiming to digitize their financial transactions.