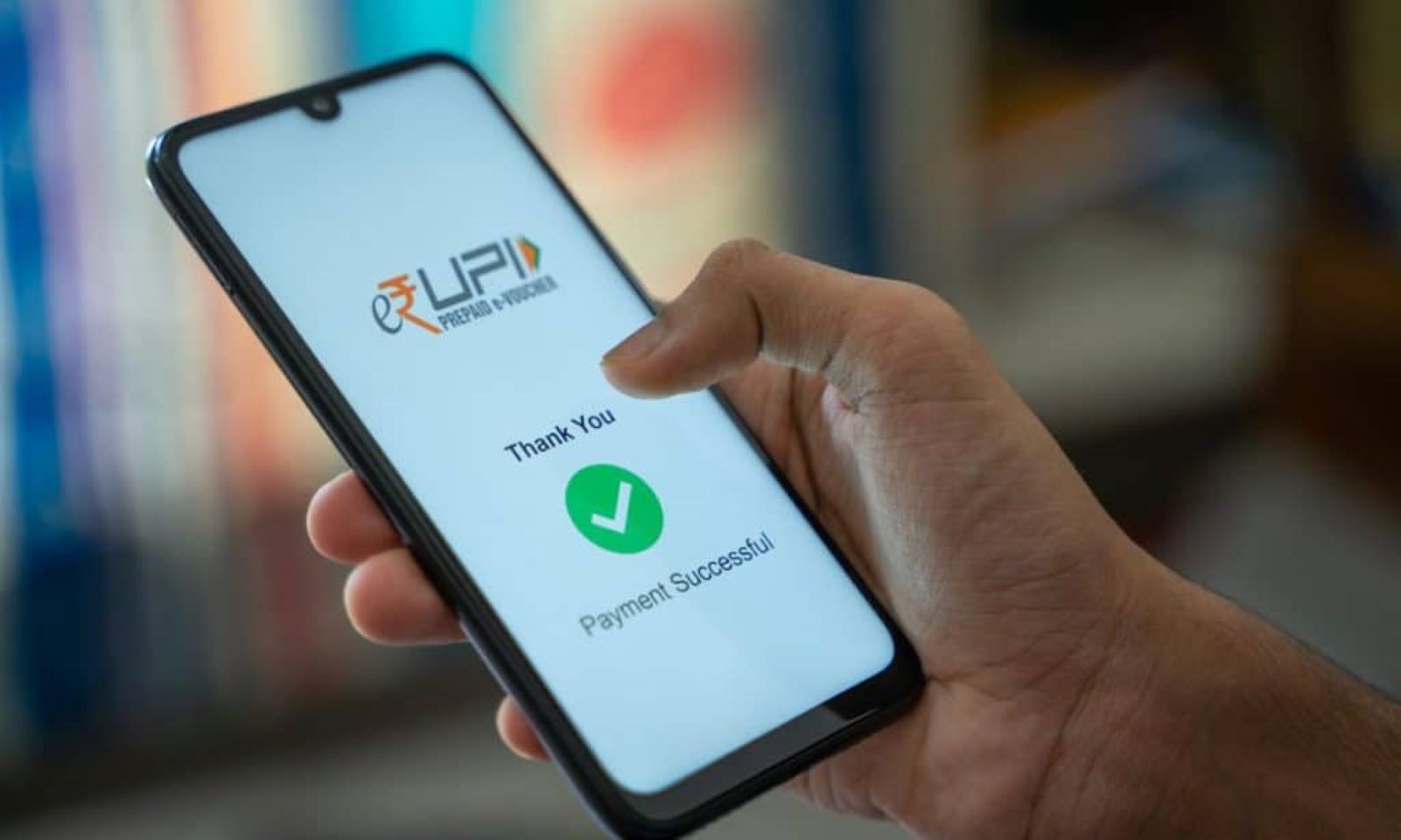

Bima-ASBA, a new payment mechanism using UPI, has launched for insurance premiums. This system allows policyholders to make payments directly from their bank accounts using their smartphones. The launch aims to streamline premium payments and make insurance more accessible.

The Insurance Regulatory and Development Authority of India (IRDAI) has been pushing for increased digital adoption in the insurance sector. Bima-ASBA is a step in that direction. It simplifies the payment process, reducing the reliance on traditional methods like cheques and demand drafts. This new system is expected to benefit both policyholders and insurers.

With Bima-ASBA, customers can link their bank accounts to their insurance policies. They can then authorize premium payments through UPI. This process eliminates the need for manual payments and reduces the risk of missed deadlines. Real-time payment confirmation provides greater transparency.

Several insurers have already integrated Bima-ASBA into their systems. This allows their customers to take advantage of the new payment option. The list of participating insurers is expected to grow as more companies adopt the system. Information about participating insurers is available on the IRDAI website and individual insurer websites.

Bima-ASBA uses the existing UPI infrastructure. This means customers do not need to download a new app or create a new account. They can use their existing UPI apps, such as PhonePe, Google Pay, or Paytm, to make payments. This leverages the widespread adoption of UPI in India.

The new system addresses some of the challenges associated with traditional insurance premium payments. Manual processes are often time-consuming and prone to errors. Bima-ASBA automates the payment process, reducing the administrative burden on insurers. It also offers greater convenience to policyholders.

Bima-ASBA is expected to increase insurance penetration in India. By making premium payments easier, it removes a potential barrier to entry for new policyholders. This could lead to greater financial security for more people.

The IRDAI is promoting awareness of Bima-ASBA among both insurers and policyholders. They are working to ensure a smooth transition to the new system. Educational materials and online resources are available to help people understand how to use Bima-ASBA.

This initiative is part of a broader push towards digitalization in the Indian financial sector. The government is encouraging the use of digital payments to promote financial inclusion and transparency. Bima-ASBA aligns with this goal.

The long-term impact of Bima-ASBA on the insurance sector remains to be seen. However, early indications suggest that it is a positive development. The system has the potential to make insurance more accessible and affordable for millions of Indians.

The IRDAI has established guidelines for Bima-ASBA to ensure security and consumer protection. These guidelines address issues such as data privacy and dispute resolution. Policyholders can contact their insurers or the IRDAI with any questions or concerns about Bima-ASBA.

Bima-ASBA is one of several initiatives aimed at modernizing the insurance sector in India. The IRDAI is also working on other projects to improve customer service and simplify policy purchase and claims processes.

The adoption of digital technologies like UPI is transforming the way financial services are delivered in India. Bima-ASBA is a prime example of this trend. It is a significant step towards making insurance more accessible and convenient for everyone.

The future of insurance payments in India is likely to be increasingly digital. Bima-ASBA is a key part of this digital transformation. It offers a glimpse into how technology can be used to improve the customer experience and make financial services more efficient.