Mastercard has chosen India for the global launch of itsPayment Passkey Service**, a groundbreaking initiative designed to accelerate secure online checkout for millions of shoppers. By harnessing biometric authentication, payment passkeys will simplify the online shopping process while bolstering security, creating a win-win situation for both consumers and businesses.

Mastercard Payment Passkey Service: Biometric Authentication for Secure Checkout

Mastercard, during a presentation at the Global Fintech Fest in Mumbai, announced the global launch of its Payment Passkey Service. The pilot program, debuting in India, will partner with major payment aggregators (Juspay, Razorpay, PayU), online merchants (bigbasket), and banks (Axis Bank). This innovative service aims to enhance security and convenience for millions of online shoppers.

Addressing Security Concerns with Payment Passkeys

While one-time passwords (OTPs) offer ease of use, they’ve become increasingly vulnerable to online scams like phishing and SIM swapping. India has seen a 300% surge in fraud cases over the last two years, with card and online payment fraud increasing by over 700%, according to the Reserve Bank of India.

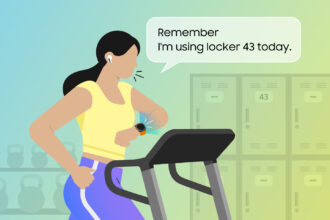

Payment passkeys offer a solution by replacing traditional passwords and OTPs with device-based biometrics (fingerprint, facial scan). This approach not only speeds up transactions but also makes them more secure against fraud.

The Mastercard Payment Passkey Service: Streamlining Online Checkout

The Mastercard Payment Passkey Service leverages passkeys and tokenization to create a secure online checkout process. No financial data is shared with third parties, significantly reducing the risk of fraud.

Here’s how it works:

- The shopper selects their Mastercard at checkout.

- They confirm payment using their device’s biometric authentication.

- The payment is instantly processed upon successful authentication.

- India’s Leadership in Digital Payments

Jorn Lambert, Mastercard’s chief product officer, emphasized the significance of this launch in India, highlighting the country’s expanding payment ecosystem and advanced tokenization market. He noted that payment passkeys and biometric authentication align with the Reserve Bank of India’s vision for a more secure payment system.

Benefits for Businesses and Consumers

The Mastercard Payment Passkey Service not only improves security but also enhances the overall shopping experience. Businesses can expect fewer abandoned carts and reduced fraud, while consumers enjoy faster checkouts and greater peace of mind.

Gautam Aggarwal, Division President, South Asia, reiterated Mastercard’s commitment to supporting India’s digitization journey. He believes that the Payment Passkey Service pilot showcases India’s global leadership in tokenization and Mastercard’s dedication to enhancing digital interactions for all stakeholders.

A Tokenized Future

The Mastercard Payment Passkey Service is designed for remote tokenized transactions, which have proven effective in reducing fraud and improving approval rates. Mastercard is bringing together EMVCo, World Wide Web Consortium, and FIDO Alliance industry standards to create a faster and more secure checkout experience.

Following the pilot in India, Mastercard plans to expand the Payment Passkey Service globally in the coming months.

Partner Perspectives

The article concludes with quotes from Mastercard’s partners (Axis Bank, Juspay, PayU, Razorpay), highlighting their enthusiasm for the Payment Passkey Service and its potential to improve payment security and user experience in the Indian market.