In a significant development in the banking sector, Trustt, a provider of digital banking solutions, has made notable strides in enhancing operational efficiency with its array of products launched in 2023. The company’s Digital Lending platform has notably streamlined customer acquisition processes, recording a 34% improvement due to its high level of automation and straight-through processing.

Key Highlights:

- Trustt’s Digital Lending platform has improved customer acquisition efficiency by 34%.

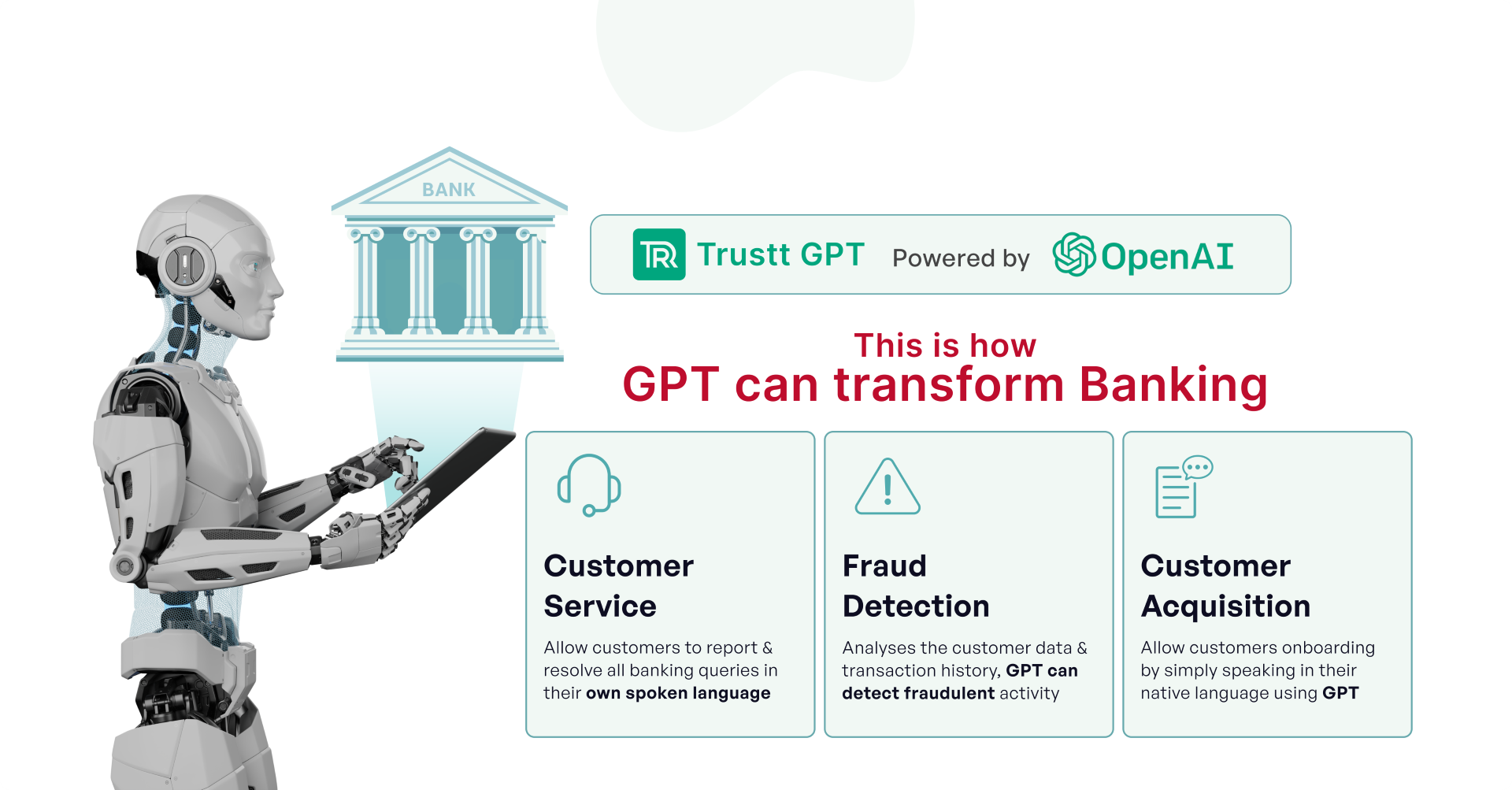

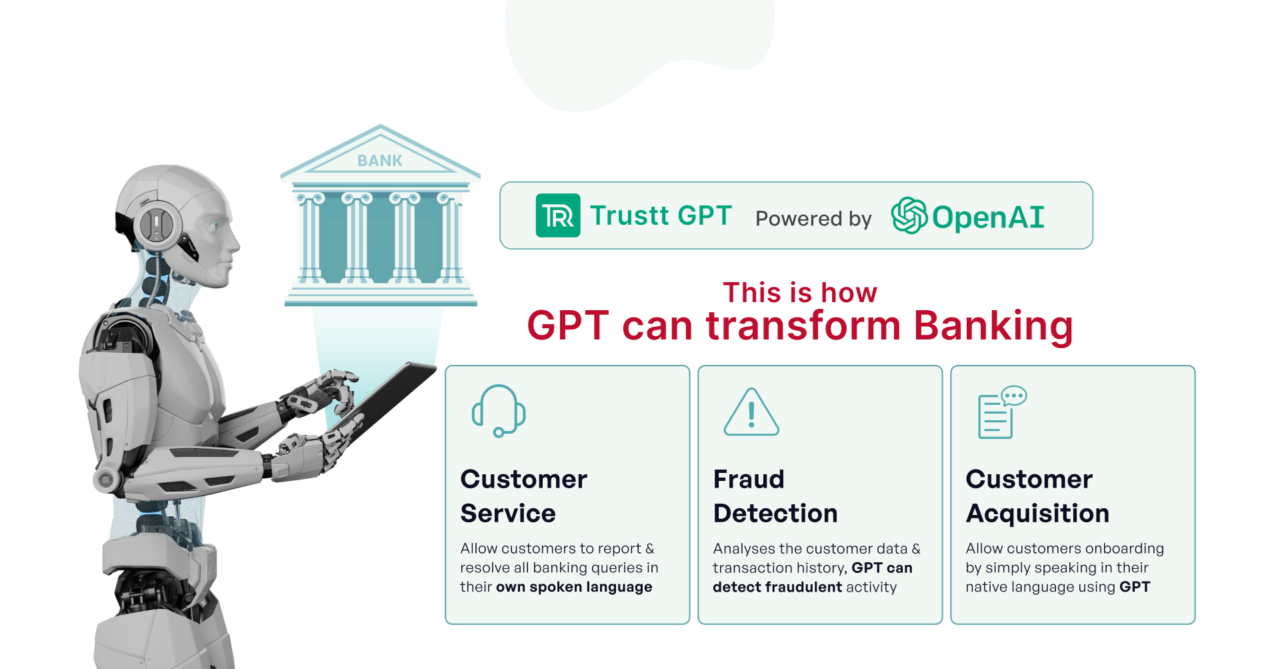

- Trustt GPT, a generative AI technology, aims to boost BFSI sales and support staff productivity by 50%.

- This AI assistant supports multiple Indian languages, facilitating personalized product discovery, streamlined customer acquisition, and enhanced customer support.

- The Digital Distribution Platform (DDP) has significantly reduced partner onboarding times and acquisition costs, improving conversion rates.

Trustt GPT, the company’s generative AI technology, is set to enhance the productivity of banking, financial services, and insurance (BFSI) sales and support staff by 50%. This AI assistant is designed to be voice-first and multilingual, capable of understanding and responding in several Indian languages such as Hindi, Tamil, and Marathi. This feature is particularly advantageous for banks in terms of personalizing product discovery, simplifying customer acquisition processes, and enhancing customer support. These capabilities are expected to attract a more diverse demographic and resolve common issues with greater accuracy and efficiency.

Mr. Srikanth Nadhamuni, Executive Chairman and Founder of Trustt, shared his insights on the company’s progress, stating, “Trustt is redefining the landscape of banking technology through digital tools and innovative BFSI products. We are excited to see the efficiency gains that our AI-powered solutions can deliver.”

Another significant product from Trustt is the Digital Distribution Platform (DDP), a comprehensive platform for Banking Correspondent Agents. This platform has revolutionized customer acquisition for clients, enabling them to onboard new customers who are new to formal banking. By reducing partner onboarding times by 80% and managing agent lifecycles efficiently, DDP has significantly boosted new customer acquisition. The platform also features advanced lead validation and prospect routing, contributing to improved conversion rates. Moreover, DDP has been instrumental in reducing acquisition costs by 50%, thereby fostering significant growth and providing a competitive edge to clients.

Reflecting on the past year, Mr. Gautam Bandyopadhyay, CEO and Co-Founder of Trustt, commented, “We celebrate these milestones with gratitude. We are excited about the potential of generative AI technologies to transform the banking experience and promote financial inclusion. Our future roadmap includes enhancing our products through the deep integration of generative AI capabilities